Want to know how to pay off a mortgage early? Here are 8 must-know steps to paying off your mortgage in this detailed post.

Looking to pay off your mortgage early? Maybe you're looking to reduce your debt or your stress. Or maybe you're just sick of making the bank rich with large monthly interest payments! Or maybe thoughts of a mortgaged property are giving you unwanted flashbacks of losing many a feisty game of Monopoly to your siblings... No matter the reason, you've come to the right place!

These below steps helped me pay off over $150,000 in student loans in just 16 months.

This post is all about paying off a mortgage early.

More about debt payoff...

📚 Table of Contents

Click to jump to a section:

1. Know Your Why

The first step to pay off your mortgage early is to have a compelling reason (or reasons) why you want to pay it off early. The more compelling the reasons, the more likely you are to succeed!

Paying off your mortgage early is a wonderful goal, but it is likely going to take years. A goal that requires years of discipline and dedication needs a compelling vision in order for you to be successful. After year 1, 2, 3... you need something to keep you going. With a goal as big as this one, you can't simply push yourself forward, you need to be pulled by a compelling vision.

So, ask yourself, why do you want to pay off your mortgage early? Perhaps you haven't thought too deeply about it, but you must. Take a few minutes right now to reflect on why you want to live your life mortgage-free. Better yet, get out a pen and paper and write down your thoughts.

To start, close your eyes and imagine yourself having completed this amazing goal. How do you feel? How does it feel to walk around your kitchen, or step on the grass in your yard knowing that now YOU own it, not the bank? What would you do with the extra income in your budget? What would you buy? What would you give? How would your relationships improve? Would you work at the same job if you didn't have a mortgage? How would life feel without the stress of an enormous monthly payment?

If you're married, I highly recommend you do this exercise with your spouse! Both of you need to get on board in order to make this work.

Take the time to get clear on the reasons you are committed to this goal. Take time to create a compelling vision of the future in your head, and then commit to the vision.

2. Get Your Spouse on Board

Married couples have the largest share of mortgages, which means if you're reading this you're likely married (if you're not, skip to #3!).

Before you embark on this lofty goal of having a paid-for-house, it's important that you and your husband or wife are on board. If they aren't, it's incredibly unlikely you'll be successful, and it's almost guaranteed that it will take way longer to pay it off.

Two people working towards the same goal is twice as effective. You both contribute to household income and expenses, so both of you are needed to pay off your mortgage. This is a goal that should and needs to be shared together, as a team. Unless both of you are in agreement about the direction you're moving as a couple, you won't really move anywhere.

If this doesn't seem possible for you and your spouse right now, consider marriage counseling to help you both get on the same page about co-managing your finances. This is an opportunity to greatly improve your marriage by improving the way you work as a team. Marriage means you sacrifice together and co-create your dreams together.

3. Use a Mortgage Pay Off Calculator

The third step is to find a mortgage pay off calculator and use it! This is very important to nailing down the specifics of your goal.

Simply having the goal to "pay off the mortgage early" isn't specific enough. You could theoretically pay off your mortgage one day early and you will have "met" your goal. But you and I both know that's not your true goal, you want to pay off your mortgage early enough to make a difference financially and otherwise. That's where a calculator comes in.

A mortgage pay off calculator (like this) helps you model timelines and interest saved.

Go ahead and pull up your mortgage information and use the calculator. You don't need to know exactly how much in extra payments you'll be able to make, but go ahead and give a good guess in order to use the calculator. Even if you don't know how much extra money you're going to throw at the mortgage yet, using a mortgage pay off calculator can be really helpful and motivating.

For example, what would your extra payment have to be for you to pay off your mortgage 10 years early? What about in half the time? How much interest would you save if you paid it off in 5 years, or 10? Using this calculator might inspire you to push your goals, perhaps if only an extra $100 a month is needed to pay off your mortgage in 1/2 the time, say.

The best thing about paying off a mortgage early is that the amount you can pay towards the principal increases every month, so you're actually making exponential progress even if you're not paying any additional money towards it. This happens because the proportion of your payment that goes towards interest decreases every month. With a traditional payment plan, this decrease is hardly noticeable, but when you're making extra payments, you'll really be able to see the needle move!

4. Get Specific

Now that you've used the mortgage calculator to see a ballpark of when you can pay it off and how much extra money you need per month to meet this goal, it's time to nail down specifics.

If you don't have a detailed, written monthly budget, it's time to make one! Yes, we all hate the b-word, but it's time to roll up your sleeves and get down and dirty with the details of your monthly expenses. Take a deep breath- it's time to see how much you've been giving to Bezos via your Amazon shopping problem...

I recommend the YNAB budgeting app. I have tried multiple budgeting apps over the years and find it to be far superior. Start your free trail here!

You can also use an Excel budgeting sheet or a simple pen and paper to track everything.

Once you have your budget, you can see how much money you have leftover at the end of the month. Is it a lot less than you thought? Wow, you're normal! Most people eat up their money with no rhyme or reason, leaving too much month leftover and not enough money. But you've raised your standards and aren't going to be a financial fool any longer. Read on for how you can start piling up cash to throw at your mortgage!

5. Pay Off Your Other Debts First

Before getting started on paying off your mortgage, the best strategy is to first pay off all your other debts. I recommend using the #1 fastest method to pay off debt in order to get this done.

Every debt that you have that should be paid off prior to tackling the mortgage. I don't recommend you pay off your mortgage before your other debts, and I don't recommend you try and pay everything off at once. Start with the smallest debt and work your way up until the largest debt is paid off, and then (and only then) is it time to tackle the mortgage!

If you want to know the 9 simple steps to pay off debt, click here!

This strategy is usually the fastest way to pay off debt and your mortgage.

Don't believe me? Unconvinced? Get out a calculator and total up all the money that you're spending on debt payments each month. Then, go back to #3 and plug in that amount into the mortgage calculator as an extra payment. How much time would that extra money save you in paying off your mortgage early? How much money would you save in interest? THIS is the power of paying off your other debts first. It frees up your #1 tool towards paying off your mortgage early, your income. If your income is eaten up going to car loans, student loans, credit cards... you won't have any leftover to go towards your mortgage!

6. Make It Fun

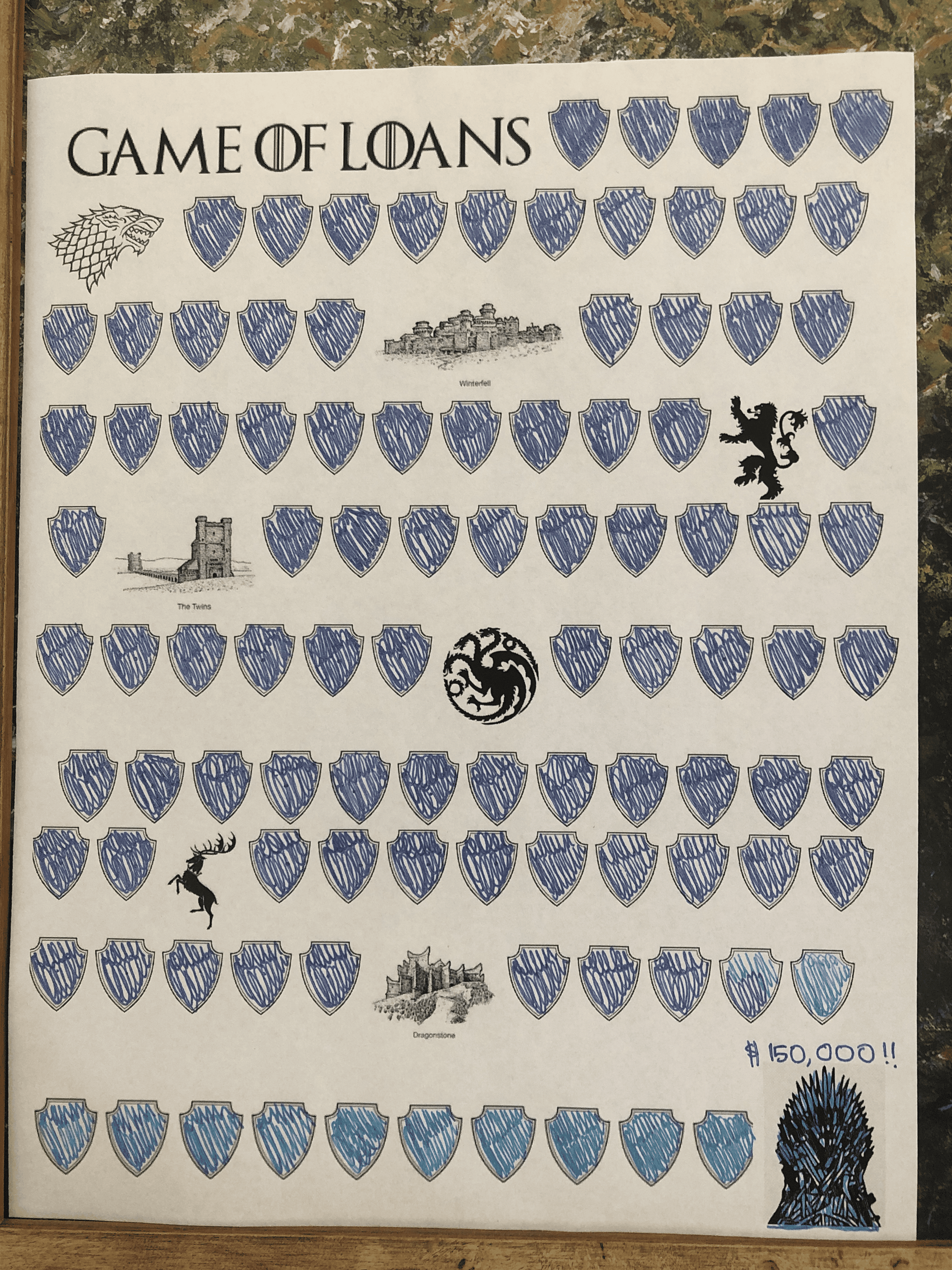

One of the best things I did when I was paying off over $150,000 in student loans was to try and make it fun. Now, what could I possibly mean by that?

Having visuals to track your progress helps keep you motivated and on track! There are several ways to do this.

When I was getting out of debt, I spent a day watching Netflix as I made dozens of paper "debt chains". Each chain symbolized a dollar amount, and every time I made a payment on my debt, I would cut them off. Every month when I cut off a chunk of chains, I sent selfies to my friends of me holding the chains! It was fun to see the chains slowly shrink down in length. Every day I looked at the chains, helping to keep me focused and motivated to one day not have to look at this ugly Matisse-inspired monstrosity on my wall! And it worked! Click here for a tutorial of how to make paper chains.

I also used a debt pay off coloring sheet that I made myself. I called mine "Game of Loans" as it was Game of Thrones themed, and I was paying off my student loans. I loved coloring it in every time I made a payment, and I hung it on my bedroom wall to keep me focused.

To find more mortgage payment trackers, simply go to etsy.com and type in "mortgage payment tracker" and there are tons to choose from!

7. Cut Expenses

Last but not least, it's time to get serious about making extra payments.

In step #4, you created a detailed budget where you audited your finances and saw exactly how much money is coming in and how much is going out.

First, go through your budget and see if there is anywhere you can slash expenses. This is the time to cancel old subscriptions. Are you getting the best rate for your insurance? Call your insurance companies and see if you're eligible for a lower monthly premium. Are you spending too much money eating out? Make a plan to start cooking at home more often. If you're serious about paying off your mortgage early, every dollar counts.

See my top 9 money saving tips here!

Food is by far one of the biggest monthly expenses for most people, so starting there is a great idea. Don't miss these 11 essential grocery saving hacks!

8. Increase Your Income

You can only cut expenses so far, right? You're not going to become a monk. So the next step is to increase the amount of money you have coming IN!

Paying off all your other debts, step #5, is by far the best way to do this. And for me, increasing my income made a much bigger difference than decreasing my expenses.

There are many ways to increase your income. If you're married, both of you could work a side hustle to bring in some extra cash. Better yet, it might be time to ask for that raise you're due for, or apply for a promotion.

What worked best for me when I was paying off my debt was getting a high-paying work-from-home job. These are my top 8 entry-level work-from-home jobs to increase your income.

FAQs about Paying off a Mortgage Early

You can speed up your mortgage payoff by making extra principal payments, cutting expenses, increasing your income, and using a mortgage payoff calculator to set a clear goal. Refinancing isn’t required to make major progress.

For most people, paying off other debts first and then tackling the mortgage gives the highest emotional and financial return. The peace, cash flow, and reduced risk of a paid-off home are hard to beat. But your personal goals should guide the choice.

Yes—biweekly payments add up to one full extra monthly payment each year, which cuts interest and shortens your loan term. It’s a simple strategy that speeds up your mortgage payoff without dramatically changing your budget.

Either works. Monthly extra payments build momentum and keep you motivated, while one yearly lump sum can create a big jump toward your goal. The key is consistency—pick the method you’ll actually stick with.

Start with subscriptions, insurance premiums, dining out, and impulse spending. Food is usually the biggest monthly leak, so tightening up your grocery budget can create hundreds of dollars per month to throw at the mortgage.

It depends on your balance, interest rate, and how much extra you can pay. Even $100–$300 a month can shave years off a 30-year mortgage. Use a mortgage payoff calculator to see exact timelines and interest savings.