Want to know how to pay off student loans fast? This post is about the best way to pay off student loans.

Consumer debt and student loans are very common (too common!). If you're like me, there's been a time when you've found yourself with too much debt and not enough money.

After I graduated from PA school, I finally did the long overdue task of totaling my debt. And boy was there some sticker shock. I was over $155,000 in debt. I felt anxious and helpless. But I decided to reject all the conventional financial advice and use a different approach.

Over the next 16 months, I paid off every cent. In this post, I'll walk you through the exact methods I used to pay off my student loans FAST and become debt-free forever.

How I Found Myself in Debt

I graduated from Physician Assistant school with over $150,000 in student loan debt. Going into PA school, I didn’t think much of taking out 6 figures in loans. My parents had generously paid for my undergraduate education, and I had never had any debt before. Nice try mom and dad, but I wasn’t about to miss out on the all-American experience of crushing student loan debt! At the time, I felt like because I had worked so hard to get accepted into PA school that I deserved to go to the best school that I could, regardless of cost.

While in school, I hardly thought of my debt, and to be honest, it felt like monopoly money. I didn’t even calculate my total debt until after graduating.

I remember that day vividly, staring into the white abyss of an Excel sheet with tears in my eyes. I stared so long that Excel actually offered to recover my unsaved document out of pity.

I had much more debt than I anticipated. I thought I owed about $130,000, but I owed over $150,000. In that moment I felt confused, anxious, and overwhelmed - but mostly afraid. What if something happened to me, and I couldn’t pay this off, like illness or an injury? I also felt a deep pang of regret for what I had gotten myself into—what was I thinking?

In anticipation of starting a job as a PA and making a six-figure salary for the first time, I purchased about a dozen personal finance books based on the top recommendations online. I wanted to educate myself and make sure I was doing right by my new income. I read several of the most acclaimed personal finance books out there.

The recommendation was to make minimum payments on my 10-year repayment plan, and invest the difference because I'd "come out ahead" due to the interest. However, I made sure to run the numbers, and I realized that with this route I wouldn't have a positive net worth for over 5 years! That felt utterly ridiculous to me.

I would feel like I was building wealth by investing money and saving for retirement, but in all reality, I was years away from actually having money. Then and there, I decided I wasn't going to take the "best" personal finance advice. I was going to make my own way, a better way.

Unfortunately for me, this meant tackling over 150k in student loans before I could have any fun. I had been planning to relax and enjoy life after graduate school. I had envisioned buying new clothes, renting a nicer apartment, and going on vacations. Hadn't I earned that by getting through school? This was an adjustment for me mentally, but after about a day, especially considering the alternative, I was more than on board.

I couldn’t deny the truth, I was flat broke. Not “tight on cash” broke the waking in the middle of the night in a cold sweat wondering, “should I sell plasma?” broke.

I felt doubtful and intimidated, but the seed of debt freedom had been planted. The vision of making my final payment was so compelling to me, and there was no talking myself out of it.

Step 1: Get Clear

The first thing I did was total my entire debt in an Excel sheet from smallest to largest. An easy way to do this is to review your credit report for free, which will tell you all the debts you owe. If you don't even know how much debt you have, don't worry! Most people have NO CLUE how much debt they're in, so you're not alone.

I then calculated how many months it would take for me to become debt-free with a strict budget and working multiple extra jobs. Every time I cut an expense, the date of debt freedom got closer. So I kept cutting expenses, and then, since the date was so close, my threshold for how much I was willing to work and sacrifice became greater.

I realized, with surprise, that I could pay off my debt in less than two years with some (well, a lot) hard work and discipline (well, feral minimalist cavewoman level discipline). You may be shocked too when you run the numbers.

This realization was critical, because I was willing to cut my lifestyle drastically if it was only 2 years. I thought, what could I give up for less than two years? A lot of discretionary spending came to mind that I wasn’t willing to consider cutting over a 10-year repayment plan. I could stop dying my hair for two years, wearing contacts, and getting my nails done. I could go without a vacation for only 2 years, surely. After all, in graduate school, the closest I got to a vacation was crying in my car between clinicals and calling it “me time.” And the best part, the more I cut my spending, the shorter the time I had to go without it.

Step 2: Get Motivated

I knew that this journey was going to be much more of a mental struggle than a math struggle, so I looked into ways to keep myself motivated.

One idea I found online was to make paper chains of debt. I got out my construction paper and scissors, and 1 season of Selling Sunset later, I was done! I assigned a dollar value to each paper chain, with the plan to cut them off as I made payments on my loans. I switched colors for every $10,000 to help break up my debt visually. I hung them in my bedroom so that they could serve as an unavoidable and daily reminder of my current financial ruin. How many months would this Matisse-inspired monster be the last thing I saw before I went to bed and the first thing I saw when I woke up?

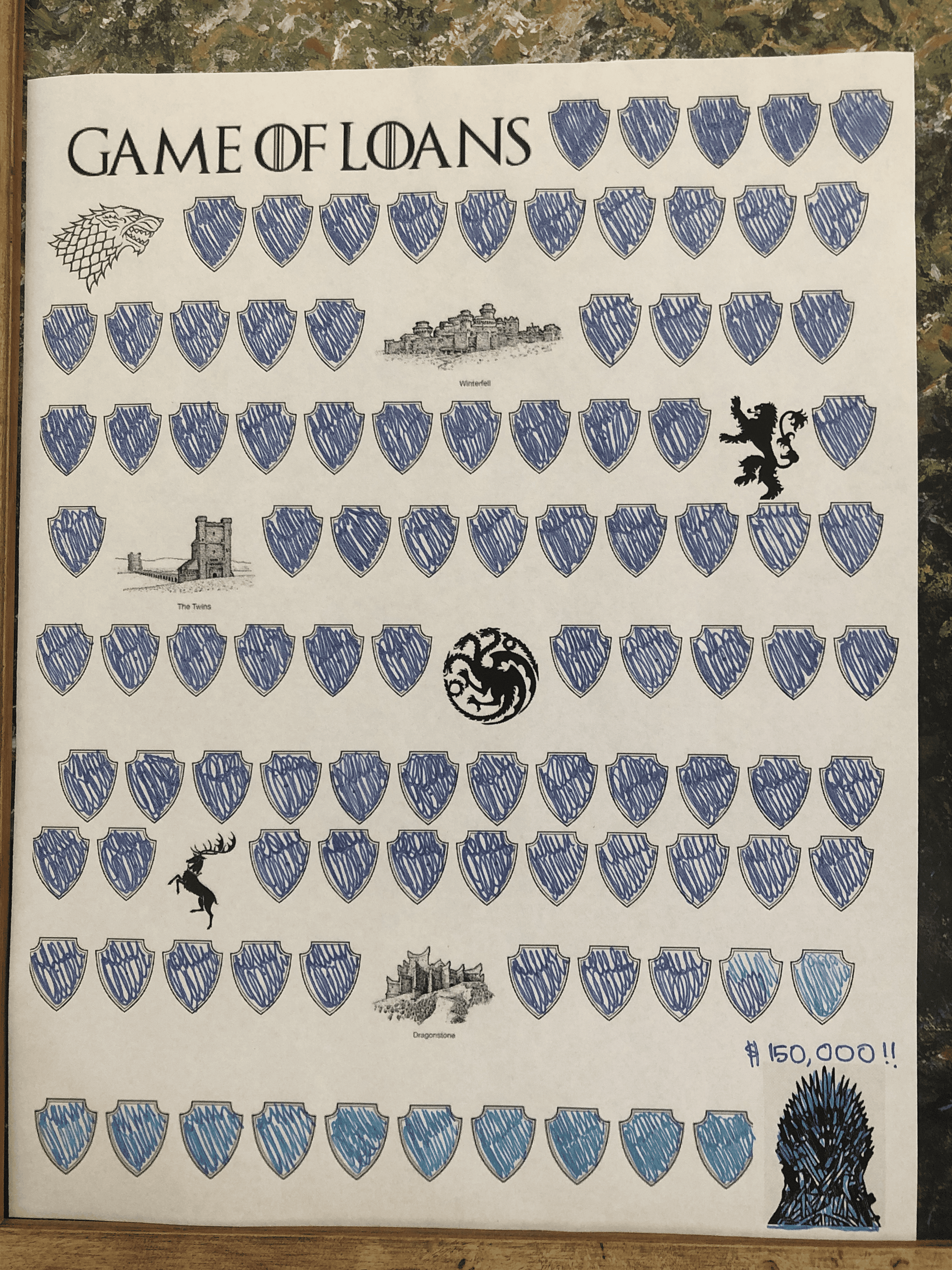

I also created a Game of Thrones inspired coloring sheet to color in as I paid off my loans. I titled it “Game of Loans,” which my mom enjoyed. Most importantly, I used the debt snowball method, which allowed me to celebrate quick victories early by starting with the smallest debt first. Throughout my debt-free journey, these little victories of removing chains and coloring in my sheet made a world of difference. It felt so satisfying and added some fun to the process.

Step 3: Cut Your Spending

As I mentioned above, cutting my lifestyle was crucial. I adopted an extremely disciplined mindset where if it was not needed to sustain life, I did not buy it. Goodbye DoorDash addiction, hello austerity!

This was easier to do when I knew that every dollar I was spending would have to be earned back through hours at work. Try asking yourself: how many hours of work is this really worth? It was an easy trade-off when I assigned a “time-at-work” amount to each dollar. $200 for a new dress? That’s 5 additional hours at work this month- not worth it. This concept is described in a life-changing book I love, Your Money or Your Life.

Ask yourself what you could live without for just a few months, knowing that you can have it as soon as you’re debt free. There was pretty much nothing I wasn’t willing to say goodbye to. The deeper you lean in, the deeper you’re willing to sacrifice, the faster you are done- and don't forget, you're done forever.

Step 4: Increase Your Income

Even more important than cutting my spending was drastically increasing my income.

As a new graduate PA, my starting salary was $110,000 at my 40-hour-a-week day job. After giving generously to the government via taxes, that left me with $6,500 per month. My minimum payment on my student loans was close to $2,000 per month (OUCH). After rent, insurance, and food, this didn’t leave me with nearly enough margin to pay off my loans in 2 years.

I buckled down and got to work applying to every job I could. I was willing to work anywhere within driving distance, in any setting, with any hours. Evenings, weekends, overnights, and holidays were all fair game. My social life would soon file for bankruptcy. As a new graduate with no experience, I was at a major disadvantage in the job market as training me properly would be an investment for the employer. I spent at least 10 hours per week applying to second jobs, often more.

As I waited to get additional work as a PA, I got lower paying jobs where I could. I hung flyers in my apartment complex advertising cleaning and pet-sitting services, and although the building management promptly ripped them down, I got a job! I was able to pet-sit at the same time I took virtual appointments, getting paid for 2 jobs at once. I also looked into the easiest and highest paying work from home jobs, and was able to make hundreds of collars online by taking surveys. I nannied and babysat as much as I could, and I picked up weekend and evening hours at my current PA job. Who needs a social life when you’ve got amortization tables??

A few months went by, but eventually my hard work paid off. I was hired at 2 additional jobs as a PA, one in a hospital and one taking virtual appointments. One job of those jobs had a policy that they did not hire PAs with less than 6 months of experience, but I was able to talk the recruiter into giving me a second interview anyways- it worked, and I got hired. I was determined and was not going to take no for an answer. Each job would add 20+ hours onto my current workload, totaling 80-100 hours per week, effectively doubling my income. Shortly after, I got a 4th part-time job working at my alma mater through begging my former professors to hire me networking.

I started all 3 jobs within 6 weeks of each other, and it was brutal. I was a new PA, and I had a lot to learn. Most days I felt completely incompetent, but I pushed through the fear that one of my many initial mistakes would get me sued. I saw my end goal clearly, and on tough days, I reminded myself that this struggle was temporary. I looked at this like a self-imposed residency, just like MD's endure. And if they can do it, I can do it.

I would get the hang of it soon, and soon after, I’d be debt free. I’d never have to work a second, third, or fourth job again if I didn’t want to, for the rest of my life!

Step 5: Have a Plan

I could not have paid off my debt without a detailed budget and mapped out plan. I used a budgeting app called YNAB and loved it. It kept me on track and motivated. I tracked every purchase and every dollar earned. In fact, I could tell you how much I spent on gum in 2022, and I wish I were joking.

I was constantly looking for ways to further cut my spending. I went over my expenses using the budgeting app every week, and I also used an excel sheet. It was surprisingly fun and motivating to see how much I could pay to my loans at the end of the month if I kept on track. Looking back, it’s a little sad (or tragic) that watching interest accrue in reverse was my version of nightlife.

I took it one day at a time and set monthly goals for myself. I concentrated on getting through the next $10,000 that I owed, and this was easier with my multi-colored chains of debt. I had a visual for how far until that goal was reached.

Step 6: Raise Your Standards

Consumer debt is a common problem today, with most people feeling like there is no way not to have it—a suffocating car payment? That’s just life. Paying interest on last year’s groceries? It's just another Tuesday!

But there is a better life waiting for you on the other side of debt. Paying off my student loans was the greatest gift I’ve ever given myself, and I will reap the rewards for the rest of my life. The time went by so fast. The first real step is to raise your standards.

Is consumer debt really a part of your ideal life? I highly doubt it. If the answer is no, know that you can pay it off and say goodbye to debt forever. I’ll end with a favorite quote I reflected on often throughout my debt-free journey:

“What are you willing to give up to go up?”

More articles you'll love...