Want the money-saving habits millionaires actually use? Here are 9 simple money saving techniques that work.

If you're like me, you're always looking for ways to save money, especially simple, money-saving techniques. The truth is, millionaires know exactly how to stretch a dollar and, more importantly, how not to WASTE a dollar. These money saving techniques are easy to use and guaranteed to save you hundreds-often quickly-when you apply them.

In this post, I will go over the exact ways to save money that millionaires use. They are the same money saving techniques that I used to pay off over $150k in student loans! I've tested these myself-use what fits your situation.

This post is all about money saving techniques.

More about saving money...

1. First Things First

The first money saving technique is simple and easy: put first things first.

Do you know what your financial goals are? Do you have a financial plan? If you're married, do you and your spouse have financial goals you're working towards together? For most people, the answer is no. Most people are simply wishing for "more money", but what is the plan once you have "more money"? How are you going to use it? Without specific and measurable financial goals, you are all but guaranteed colossal financial failure as the only possible outcome!

Rich people have detailed financial goals that they have reflected on and chosen with intentionality. Wealth comes AFTER you've decided your financial priorities.

Sit down with a pen and paper and take 10 to 15 minutes to write out your financial goals. How and when do you want to retire? What about your children's college education? What are your dream vacations or dream purchases? Take your time and dream big, let your imagination run wild with all of your dreams for the future!

After you've completed this exercise, go through and decide which of your financial goals are most important. Once you know that, for example, retirement is the first priority, you can begin to manage your finances in a way that reflects this priority.

This might be a surprising way of saving, but you'll see it makes a lot of sense. You will realize that travel or saving for your kids' college is more important than eating takeout or those fancy haircuts, allowing you to slash expenses that you don't really care about.

Pro tip: If you have any consumer debt (for example, all debt that is not your house), your #1 financial priority should be paying off all your debt. Read here for my exact strategies to pay off debt fast, even with a low income! When your priorities are clear, cutting the right expenses feels easy-not depriving.

2. I Like Big Budgets and I Cannot Lie

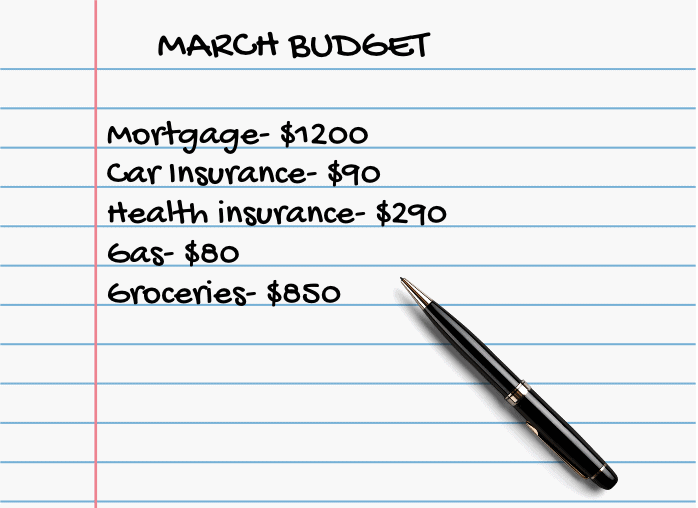

Before you can save money, you need to know exactly where your money is going. Most people have no idea! And most people aren't wealthy. Don't be like most people!

Sit down and go through all your monthly expenses. An easy way is to start with the past month. Get your bank statements and get to work. Categorize all your spending and tally up exactly how much is going to each category. You can do this with a pen and paper, a chisel and stone, Excel, Google Sheets, or with a budgeting app.

My favorite budgeting app is YNAB. Get your free trial here!

Once you realize exactly how much you're spending, you should be able to easily see where you're overspending. Take time to reflect on your spending habits. Where are you spending too much money? Where aren't you spending enough (think charitable giving or retirement contributions).

Next, create a detailed plan for your money, also known as a budget. Budgets aren't a restriction- they are permission to spend, guilt free! A big misconception is that rich people and millionaires don't have budgets, that they make so much money they don't have to pay attention to where it's going. This couldn't be further from the truth. Millionaires become millionaires by watching where their money goes closely and spending it intentionally.

3. Avoid Lifestyle Inflation

My third money saving technique to make you rich- avoid lifestyle inflation! Lifestyle inflation is when you increase your spending as your income increases, thus quickly obliterating any margin in your budget, and therefore any opportunities for extra savings!

Millionaires become millionaires by living below their means. This means that you don't increase your spending as you increase your means, see what I mean...s? It is beyond tempting to embrace the "treat yo'self" mentality as soon as we see any extra income, but one of the best saving techniques is to keep your expenses low even as your income increases. Don't run to get a nicer car right after you get a pay raise!

Lifestyle inflation is a wealth killer because it's very easy to inflate our lifestyle, but very difficult to "deflate" it. Once we've gotten used to going out to lunch every day, it's hard to go back to brown bagging it. That's why avoiding lifestyle inflation in the first place is paramount.

4. Automatic, Supersonic

Number 4 on the list of the best money saving techniques is to automate your savings. Make smart automatic, make stupid difficult. This is the mentality I use to save thousands of dollars a year!

Now that you completed step 1 and know what your financial priorities are, you can automate saving for your goals. Most banks allow you to set up automatic transfers to savings accounts online, and you can call HR and set up automatic deposits to any retirement accounts. Want to save $1,000 for a trip in 10 months? Set up an automated $100 monthly deposit into your vacation savings account. When it's time for the trip, the money will be there waiting!

This money-saving technique really works because it takes away the mental load of saving each month. Instead of having to manually go into your bank account every month and put money into savings, it's already done for you. This eliminates all the temptation to NOT transfer money to your savings that would inevitably come up. Better yet, if the money is put into savings before you can see it in your checking account, you won't even feel the pain of moving it! So much of personal finance is a mental game, not a math one, and this easy money saving technique proves it.

5. Earn Interest

The next money saving tip I'll recommend is super simple! Make it a priority to earn interest where you can. I recommend doing this in two ways.

Number 1 is to use a high yield savings account for all your savings. Your emergency fund (3-6 months of expenses) and any other savings goals you have in the next 5 years should be held in a HYSA. HYSAs offer higher interest rates than traditional checking accounts. My personal HYSA offers 4% annual interest, as an example (although rates change). That's 4% I earn by doing nothing! By simply transferring your money from your checking account to a HYSA, you can save hundreds of dollars in earned interest each year.

Keep in mind, that HYSAs allow a limited number of withdrawals for each month (limits vary by bank). This is what makes them different from a checking account. If you're using them as they're intended, for long term savings, then this shouldn't be an issue.

The second way I recommend you use interest to your advantage is through investing! If you're not investing for retirement yet, now is the time to start. Your 401k and/or Roth IRA is a great way to earn "free money" in interest. Talk to your HR department about how to get started with your accounts and start earning hundreds in compound interest!

6. Check Your Subscriptions

Do you know how much you're spending each month on subscriptions? Yeah, most of us underestimate this by a lot. Most people don't realize how much they're spending on monthly subscriptions! Most people are actually spending 3x what they estimate on monthly subscriptions. Like a giant streaming services snowball, they can really add up over the years. Take your eyes off the road, and one day you wake up and realize you've been spending hundreds of dollars over the years on Godiva's truffle of the month club! Or so I've heard...

Sit down and take the time to go through all of your monthly subscriptions. The easiest way to do this is by looking through your bills and bank statements to see what's being charged. If you have an iPhone, check for all your current Apple subscriptions. More likely than not, you'll find a few that you can cancel right away. And you might find others that you can downgrade by signing up for ads, for example. I cut my Netflix subscription in half by downgrading to a subscription with ads. It was near painless as there's only 1-2 ads per episode! Truthfully, I barely notice them.

Pro tip: Anything you haven't used in 6 months should be canceled! If you're undecided about a subscription, cancel it. If and when you realize you really want or need it, you can add it back to the budget. But spoiler alert, you'll probably forget about it!

7. Try a "No Spend" Challenge

Nothing brings people together like trying to curtail your horrid Amazon spending habit! Find a community through a "No-Spend" or "No-Buy" challenge. A No-Spend challenge is when you pledge to stop spending money on certain days for a certain length of time. For example, not spending money for 15 days out of the month. There are tons of creators online, like this one, on virtually every platform, that are offering a No-Spend challenge at any given time. You can find ones that last a week, a month, or even a year!

A No-Spend challenge is a great money saving technique because it allows you to reduce your expenses by eliminating days that you can spend money. Most of us will find that we are spending money, in some way, almost every single day! And a lot of the time it's unnecessary spending. Participating in a No-Spend challenge tackles this problem head on, and it allows you to bond with other participants at the same time!

8. Hire a Tax Pro

Tax evasion is illegal, but legal tax optimization is smart. We don't want any extra money ending up in Uncle Sam's pockets that doesn't need to be there. One of the best money saving tip is to hire a tax professional to do your annual taxes.

Hiring a professional accountant to file your taxes is a simple way to save hundreds, if not thousands, in taxes each year. Services like TurboTax are easy and convenient (I have used them!), but their simplicity doesn't allow you to take advantage of all the ways you can avoid paying taxes. In the US, our tax code is extremely complex, which is why people like tax professionals can make a living knowing the ins and outs of filing taxes.

If you really want to save money, making the investment in a tax pro is more than worth it! They do cost more money upfront, but you will often more than cover their fee-especially in complex situations.

9. Your Money is Your Time

Last but not least on my list of money saving techniques is a mental shift that will save you thousands of dollars a year.

Start looking at your money as your time. Let me explain. For example, let's say you make $30/hour. After taxes, you actually bring home $22/hour. Now let's say that you're online shopping and there's a sweater you love that costs $45. Instead of looking at that sweater as costing you $45 (and instead of $60 because it's on sale!!), look at that sweater as costing you 2 hours of your life. With this mindset, 4 sweaters is an entire work day! How does that feel? Good? I doubt it.

Your money is quite literally your time. And your time is, when it comes down to it, your life AND your most precious resource. When you are wasting money, you are wasting your time, and by extension your life! Would you really want to spend an extra 2 hours at work for that sweater? Or those shoes? Maybe the answer is yes, but often times, I bet, the answer would be no. Looking at all your money spent with this mindset will leave you no choice but to cut meaningless expenses ruthlessly.

More posts like this...

FAQs about Money Saving Techniques:

The easiest places to start are tracking your spending, canceling unused subscriptions, automating savings, and doing a short no-spend challenge. These give you quick wins without overhauling your entire life, and they build confidence fast.

Millionaires save by living below their means, avoiding lifestyle inflation, setting clear financial priorities, and automating wealth-building habits. They’re intentional, not impulsive—and they consistently make small, smart decisions that compound over time.

Yes—automation removes willpower from the equation. When your savings move automatically, you stop “deciding” whether or not to save and start building wealth on autopilot. It’s one of the most effective long-term money habits.

You can stop lifestyle inflation by keeping your lifestyle the same even as your income grows and giving every extra dollar a specific job. Automate savings and debt payments so your priorities get funded first. The less you “upgrade,” the faster your wealth builds.

Use a budgeting method that gives you clarity and control. You can use a spreadsheet, an app, or a simple pen-and-paper system—the tool doesn’t matter as much as consistency. The point is to know exactly where every dollar is going.

Start by reviewing last month’s spending. Highlight anything you haven’t used in 90 days, anything that doesn’t align with your top financial priorities, and any subscriptions you forgot you had. Those are usually the first to go without affecting your quality of life.